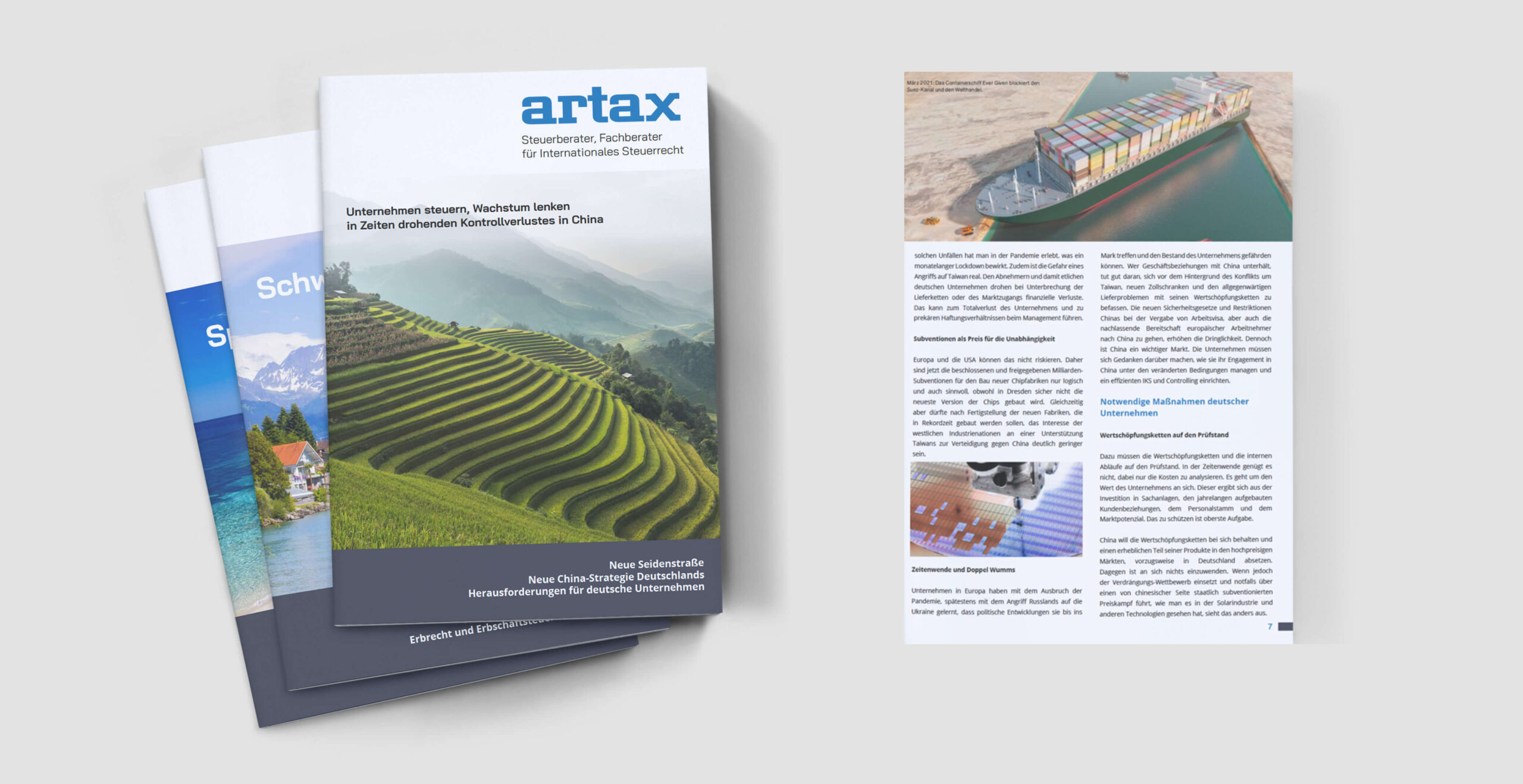

International tax law & management consulting

Experts in international tax law and an eye for the big picture. Travel safely worldwide for business and private purposes with artax.

30+ years of experience in international tax law and management consulting.

artax offers comprehensive support in international tax matters. An experienced team supports companies and private individuals with a variety of issues, including the optimization of corporate strategy, tax-efficient arrangements and the establishment of foreign subsidiaries or their conversion. artax also supports questions about moving and working abroad, home office solutions and reducing business premises risks. Our expertise extends to international tax law, for example in Switzerland, Spain, the USA and China.

Secure values, build on growth, secure the future and use professional tax advice to ensure that you make optimal use of tax opportunities and minimize potential risks.

As a competent partner, we also support you in Switzerland and offer tailor-made tax solutions that are tailored to the specific requirements and laws of this country.

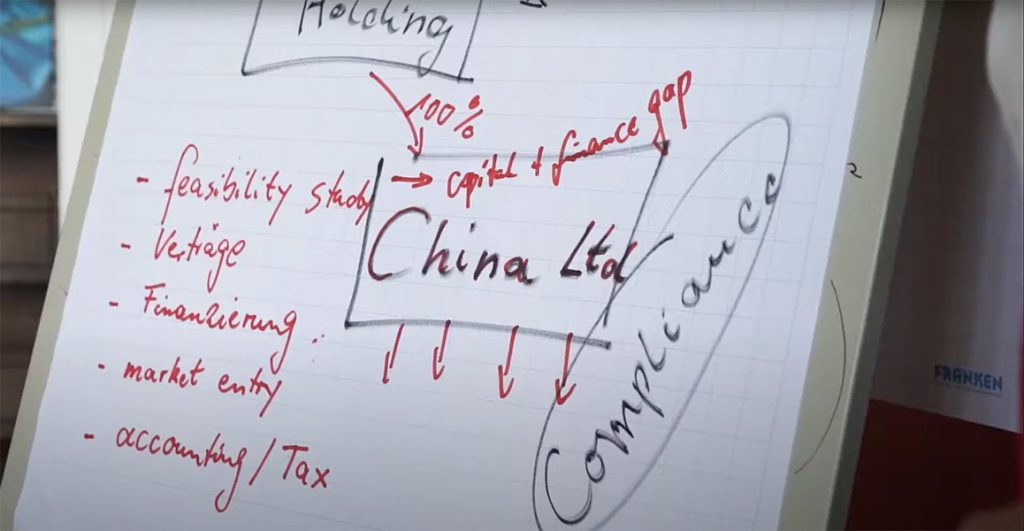

We are competent partners for companies operating in Asia and offer you comprehensive tax expertise to effectively support your business activities in this region.

Take advantage of our know-how with our law firm directly in Palma - with comprehensive tax advice that is tailored to the specific needs and circumstances of the Balearic Islands.

Always up to date on tax law in Austria: Our experienced team of tax experts ensures that you can handle your tax matters efficiently and in accordance with the law.

Secure values, build on growth, secure the future and use professional tax advice to ensure that you make optimal use of tax opportunities and minimize potential risks.

Companies based in the USA benefit from our global experience because we offer tailor-made tax advice that takes into account the specific requirements of US tax law.

As a competent partner, we also support you in Switzerland and offer tailor-made tax solutions that are tailored to the specific requirements and laws of this country.

Working from home in Mallorca, taxes and social security in Spain

Home office is the new normal in the working world. Working in another place, in another country has consequences in terms of marriage and inheritance law, social security and taxes. This applies to all employees, and it also affects the companies they work for. Palma de Mallorca and Barcelona are ideal places for mobile working.

Discover our extensive tax law services

artax can support its clients in developing tax strategies and plans for international transactions and business activities. This includes optimizing the tax structure, selecting appropriate jurisdictions and identifying tax benefits.

- March 5, 2024

- 22 January 2024

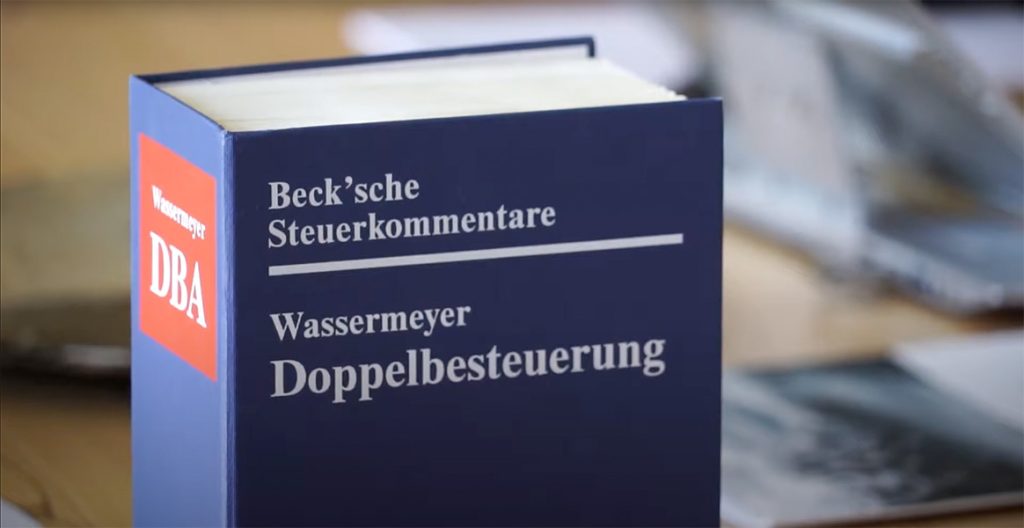

International tax law

for private individuals and companies

artax as a partner for companies

We are medium-sized companies and speak your language. With us you have a permanent contact person for all your questions. This is especially true if you operate across borders, e.g. conduct online trading, maintain foreign permanent establishments or set up a subsidiary. The focus of our work is: advice on international tax strategy, tax planning, taxation of permanent establishments, documentation of transfer prices, secondment of employees, employment of foreign employees.

Tax law Germany-Switzerland

The border between Germany and Switzerland is an EU external border. Nevertheless, people and companies have largely the same freedoms through the bilateral agreements as within the EU. However, when it comes to social security, taxation of income and assets, gifts and inheritance, the smallest details are important and lead to significant differences. Due to our proximity to the border (Waldshut-Tiengen) and many years of experience, we control the tax laws in both countries.

artax as a partner for private customers

People don't just live and work where they were born. Couples do not always have the same nationality or have changed nationality in the past. You not only invest your assets in your country of origin, but also have real estate and other investments abroad. Children study abroad... All of these are reasons to use artax's special expertise in private law. National and international tax law is based on this. We advise our private customers individually and according to the situation.

As an expert, artax provides interdisciplinary information in all aspects of tax law and related areas.

As an expert, artax provides interdisciplinary information in all aspects of tax law and related areas.